- Book a free consultation

- 02 9986 1547

- info@barringtonata.com.au

15 April 2024

Published by Barrington Accounting on 15 April 2024

Categories

For businesses in Australia, providing fringe benefits to employees can be a valuable way to attract and retain talent, as well as incentivise performance. However, employers […]

Do you like it?

8 April 2024

Published by Barrington Accounting on 8 April 2024

Categories

For businesses, maintaining profitability and financial stability is essential for long-term success. At times, this can lead to costs needing to be cut. However, cost-cutting initiatives […]

Do you like it?

2 April 2024

Published by Barrington Accounting on 2 April 2024

Categories

For small businesses in Australia, managing superannuation payments for employees can be a time-consuming and complex task. Super guarantee payments must be made quarterly, with the […]

Do you like it?

25 March 2024

Published by Barrington Accounting on 25 March 2024

Categories

Ensure you’re up to date on how to claim your working-from-home expenses! As the business landscape shifts back and forth between office, hybrid and home-based work […]

Do you like it?

20 March 2024

Published by Barrington Accounting on 20 March 2024

Categories

As April rolls around, businesses have a perfect opportunity to refresh their content marketing strategies and engage with their audience in new and exciting ways. With […]

Do you like it?

14 March 2024

Published by Barrington Accounting on 14 March 2024

Categories

Selecting the right superannuation fund is a crucial decision that can significantly impact your financial future in retirement. With numerous options available, it’s essential to understand […]

Do you like it?

7 March 2024

Published by Barrington Accounting on 7 March 2024

Categories

With the FBT season on the horizon, it’s time to prepare for your tax return, whether or not you offer fringe benefits to your employees. Fringe […]

Do you like it?

4 March 2024

Published by Barrington Accounting on 4 March 2024

Categories

For businesses operating in Australia, navigating the intricacies of the Fringe Benefits Tax (FBT) is essential to ensure compliance with tax regulations and minimise financial liabilities. […]

Do you like it?

26 February 2024

Published by Barrington Accounting on 26 February 2024

Categories

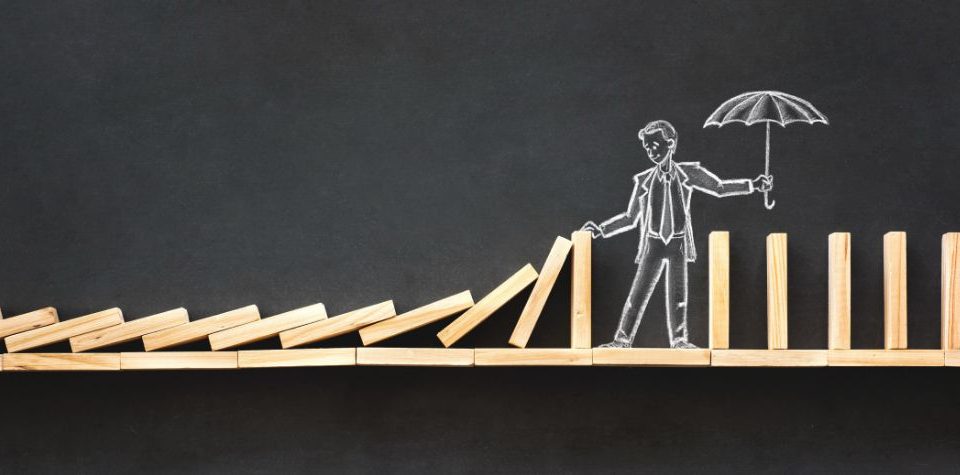

Starting and running a business is an exhilarating journey filled with opportunities for growth and success. However, along the way, entrepreneurs inevitably encounter trials and tribulations […]

Do you like it?

29 April 2021

Published by Barrington Accounting on 29 April 2021

Categories

Paying off the mortgage may sound like a dreary trudge to the end of a marathon’s finish line. However, there are options available for those who […]

Do you like it?

28 April 2021

Published by Barrington Accounting on 28 April 2021

Categories

A tried and true method of investment, trusts are generally and commonly known as being for the wealthier elements of society. A trust however is a […]

Do you like it?

27 April 2021

Published by Barrington Accounting on 27 April 2021

Categories

When branding your business, it’s important to consider all aspects of marketing. Businesses should utilise their marketing and branding strategies effectively to promote not only their […]

Do you like it?

26 April 2021

Published by Barrington Accounting on 26 April 2021

Categories

It’s likely that you’re already aware that people can put money into their super up until they reach 67 years, and probably already do so yourself. […]

Do you like it?

22 April 2021

Published by Barrington Accounting on 22 April 2021

Categories

Sometimes there are a few unexpected expenses that can impact on our financial situations, and make things just a little more difficult to deal with. The […]

Do you like it?

21 April 2021

Published by Barrington Accounting on 21 April 2021

Categories

With a significant number of Australians approaching retirement and looking at the best ways to maximise their retirement assets and income from their super for it, […]

Do you like it?

19 April 2021

Published by Barrington Accounting on 19 April 2021

Categories

It’s a daunting task, seeking someone who can fill a specific position that your business needs filled. It’s important that irrespective of how the economy is […]

Do you like it?

19 April 2021

Published by Barrington Accounting on 19 April 2021

Categories

In Australia any income earned by a job may be considered to be taxable income. Those who receive their income via the sharing economy are no […]

Do you like it?

16 April 2021

Published by Barrington Accounting on 16 April 2021

Categories

When a business cannot deal with the workload in house, a candidate or party outside of the business is often hired to assist in performing those […]

Do you like it?