- Book a free consultation

- 02 9986 1547

- info@barringtonata.com.au

15 April 2024

Published by Barrington Accounting on 15 April 2024

Categories

For businesses in Australia, providing fringe benefits to employees can be a valuable way to attract and retain talent, as well as incentivise performance. However, employers […]

Do you like it?

8 April 2024

Published by Barrington Accounting on 8 April 2024

Categories

For businesses, maintaining profitability and financial stability is essential for long-term success. At times, this can lead to costs needing to be cut. However, cost-cutting initiatives […]

Do you like it?

2 April 2024

Published by Barrington Accounting on 2 April 2024

Categories

For small businesses in Australia, managing superannuation payments for employees can be a time-consuming and complex task. Super guarantee payments must be made quarterly, with the […]

Do you like it?

25 March 2024

Published by Barrington Accounting on 25 March 2024

Categories

Ensure you’re up to date on how to claim your working-from-home expenses! As the business landscape shifts back and forth between office, hybrid and home-based work […]

Do you like it?

20 March 2024

Published by Barrington Accounting on 20 March 2024

Categories

As April rolls around, businesses have a perfect opportunity to refresh their content marketing strategies and engage with their audience in new and exciting ways. With […]

Do you like it?

14 March 2024

Published by Barrington Accounting on 14 March 2024

Categories

Selecting the right superannuation fund is a crucial decision that can significantly impact your financial future in retirement. With numerous options available, it’s essential to understand […]

Do you like it?

7 March 2024

Published by Barrington Accounting on 7 March 2024

Categories

With the FBT season on the horizon, it’s time to prepare for your tax return, whether or not you offer fringe benefits to your employees. Fringe […]

Do you like it?

4 March 2024

Published by Barrington Accounting on 4 March 2024

Categories

For businesses operating in Australia, navigating the intricacies of the Fringe Benefits Tax (FBT) is essential to ensure compliance with tax regulations and minimise financial liabilities. […]

Do you like it?

26 February 2024

Published by Barrington Accounting on 26 February 2024

Categories

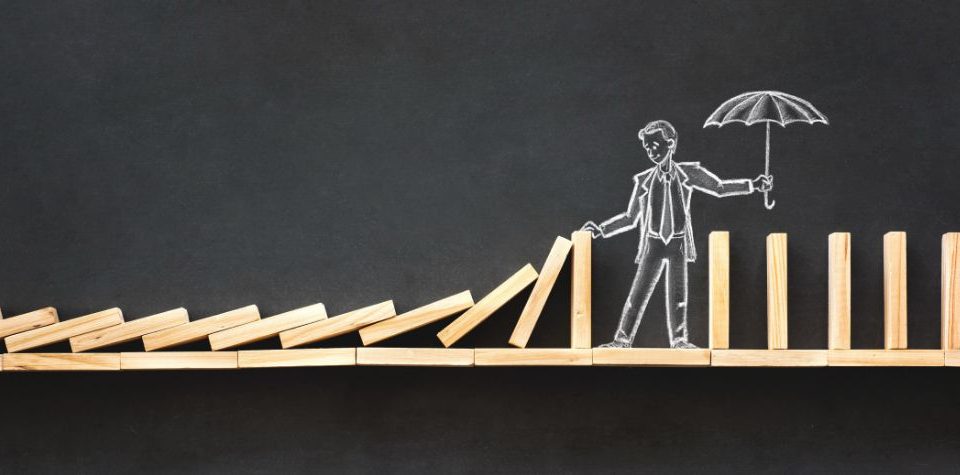

Starting and running a business is an exhilarating journey filled with opportunities for growth and success. However, along the way, entrepreneurs inevitably encounter trials and tribulations […]

Do you like it?

27 July 2021

Published by Barrington Accounting on 27 July 2021

Categories

If you’re looking to go into business with someone, the chances are that you might be looking at using a business structure known as a partnership. […]

Do you like it?

19 July 2021

Published by Barrington Accounting on 19 July 2021

Categories

A family trust is a great structure. It provides tax flexibility whilst giving you asset separation in two directions. But what does asset separation in two […]

Do you like it?

12 July 2021

Published by Barrington Accounting on 12 July 2021

Categories

It’s the truth! From tax returns to business planning, setting up a trust and so much more, we are the people you can turn to when […]

Do you like it?

12 July 2021

Published by Barrington Accounting on 12 July 2021

Categories

Have you, over the course of the past financial year, received a government assistance payment, support payment or disaster relief supplement? There have been a number […]

Do you like it?

5 July 2021

Published by Barrington Accounting on 5 July 2021

Categories

Sometimes you might want to set up a structure where you will share in the spoils with everyone that deals with that structure. There is a […]

Do you like it?